Your brilliant idea is useless without the fuel to bring it to market.

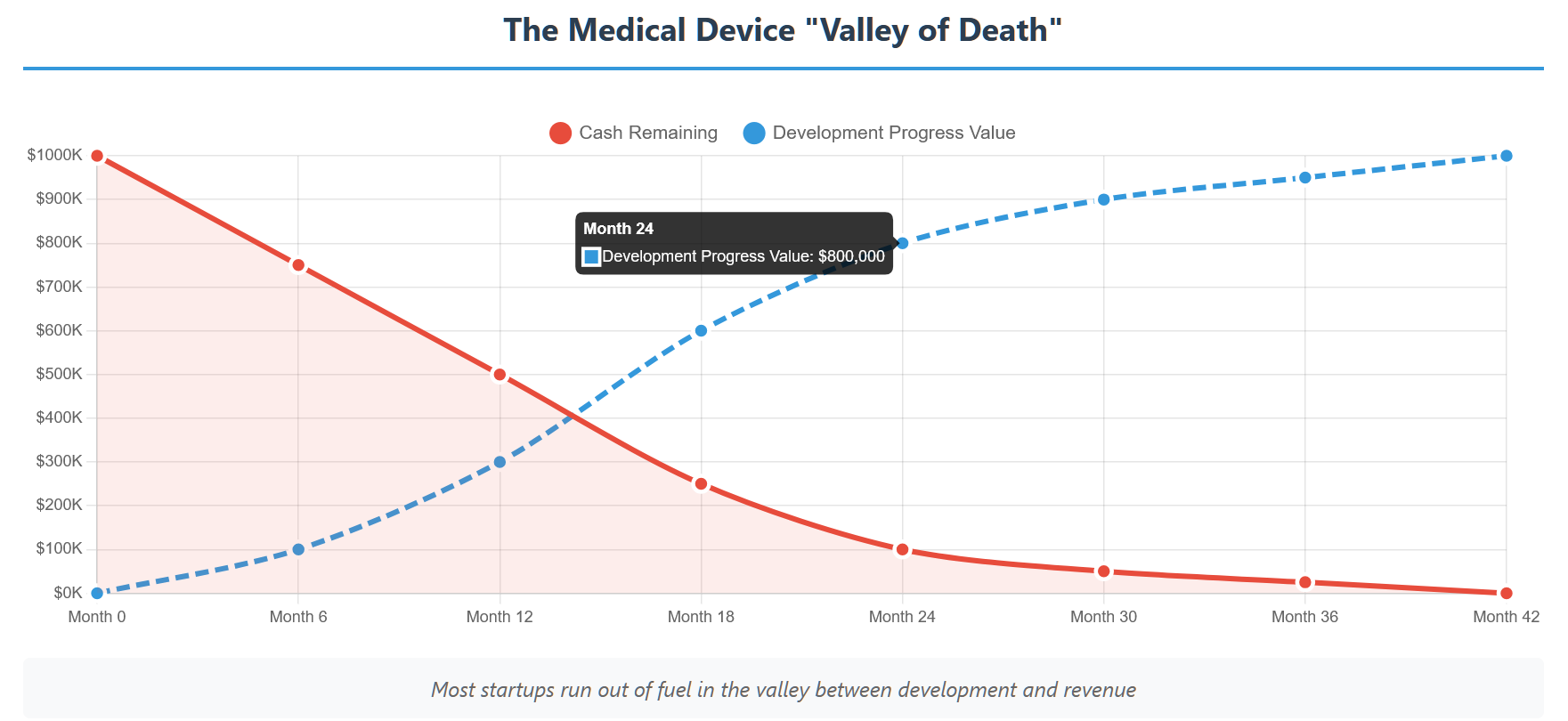

I’ve watched it happen dozens of times. A brilliant entrepreneur with a game-changing medical device idea secures their initial funding, hires a team, starts development… and then runs out of money 18 months later with nothing but prototypes and mounting bills to show for it.

The culprit isn’t usually a bad idea or poor execution. It’s the fuel problem.

Think of your startup like a rocket trying to reach orbit. You need enough fuel not just to get off the ground, but to reach escape velocity and stay in space. Most medical device startups pack enough fuel to get 10 feet off the launch pad, then wonder why they come crashing down.

The Reality of Medical Device “Escape Velocity”

Unlike software startups that can reach profitability with relatively small investments, medical devices have a much higher escape velocity. You’re not just building a product—you’re navigating regulatory approval, clinical validation, manufacturing setup, and market adoption in one of the most conservative industries on Earth.

Here’s the brutal math: most medical device startups need 3-5 years to reach meaningful revenue. During that time, you’re spending money on development, regulatory affairs, clinical studies, manufacturing setup, and team salaries—while generating zero income.

The average medical device startup burns through $200,000-$500,000 per year just to keep the lights on. That’s before you add major expenses like clinical trials ($500K-$2M) or manufacturing tooling ($100K-$1M).

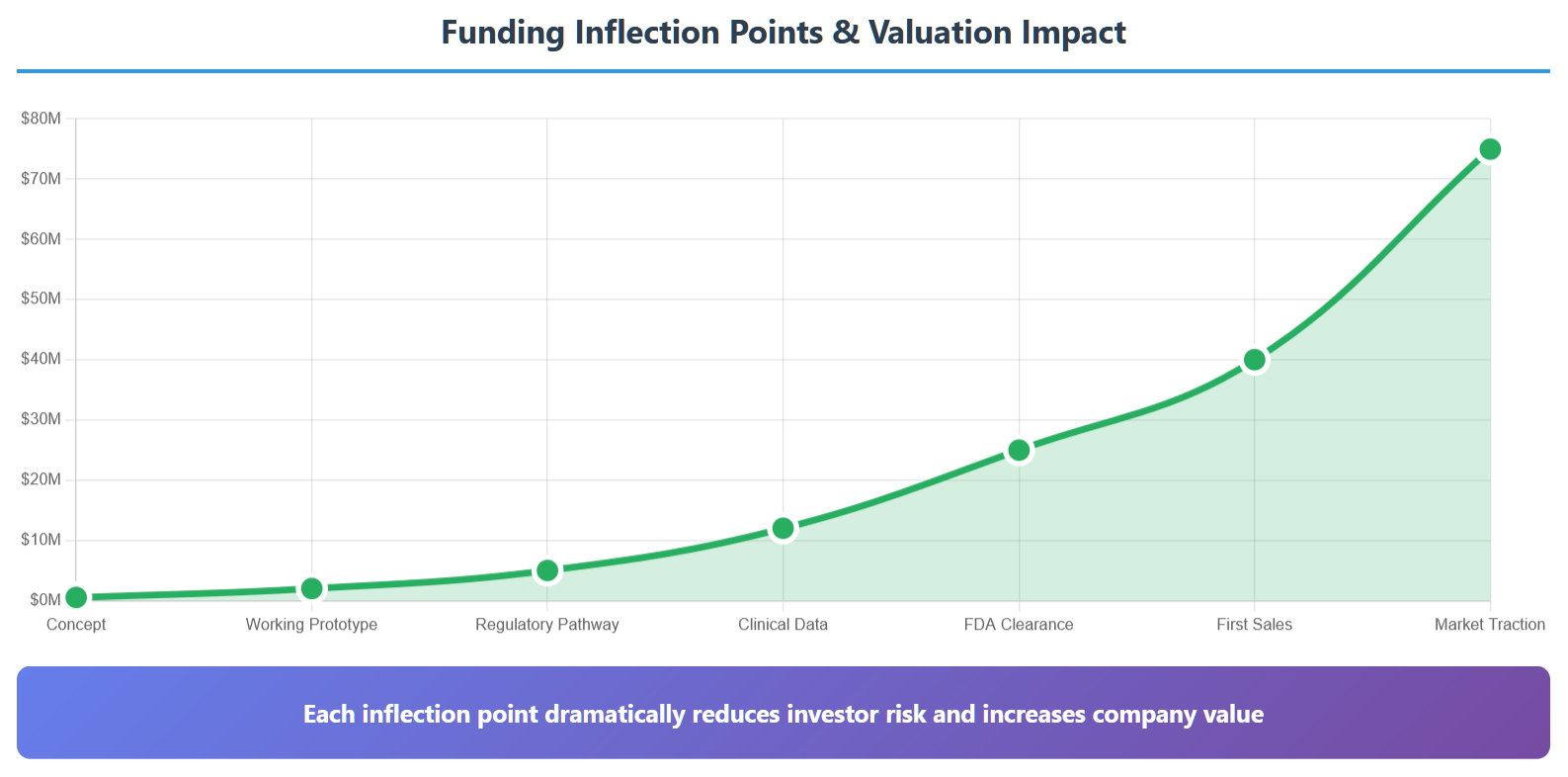

The Inflection Point Strategy: What You Actually Need to Show Investors

Most entrepreneurs make the fatal mistake of trying to build a complete product before seeking serious funding. This is backwards thinking that leads to the valley of death.

Instead, you need to think in terms of inflection points—specific milestones that dramatically increase your company’s value and reduce investor risk. Your job isn’t to build the perfect device; it’s to reach the next inflection point with minimal cash burn.

Here are the key inflection points that matter to investors:

1. Proof of Concept ($500K-$2M valuation)

Show that your device actually works. This doesn’t need to be pretty or manufacturable—it just needs to demonstrate the core functionality. A breadboard circuit that successfully collects data is infinitely more valuable than the most beautiful PowerPoint deck.

2. Working Prototype ($2M-$5M valuation)

Something that looks and feels like a real device. Investors need to hold it, use it, and envision it in a hospital. This is where industrial design and user experience become critical.

3. Regulatory Pathway Clarity ($5M-$12M valuation)

Concrete evidence of your FDA strategy. Pre-submission meetings completed, predicate devices identified, clinical requirements defined. Investors fear regulatory uncertainty more than technical risk.

4. Clinical Validation ($12M-$25M valuation)

Data proving your device works in real clinical settings. This doesn’t always require a full clinical trial— pilot studies, case reports, or comparative effectiveness data can be sufficient.

5. FDA Clearance ($25M-$40M valuation)

The holy grail for medical device investors. You’ve proven you can navigate the regulatory process and your device is legal to sell.

6. First Sales ($40M+ valuation)

Proof that customers will actually pay money for your solution. Even a few initial sales dramatically reduce commercial risk.

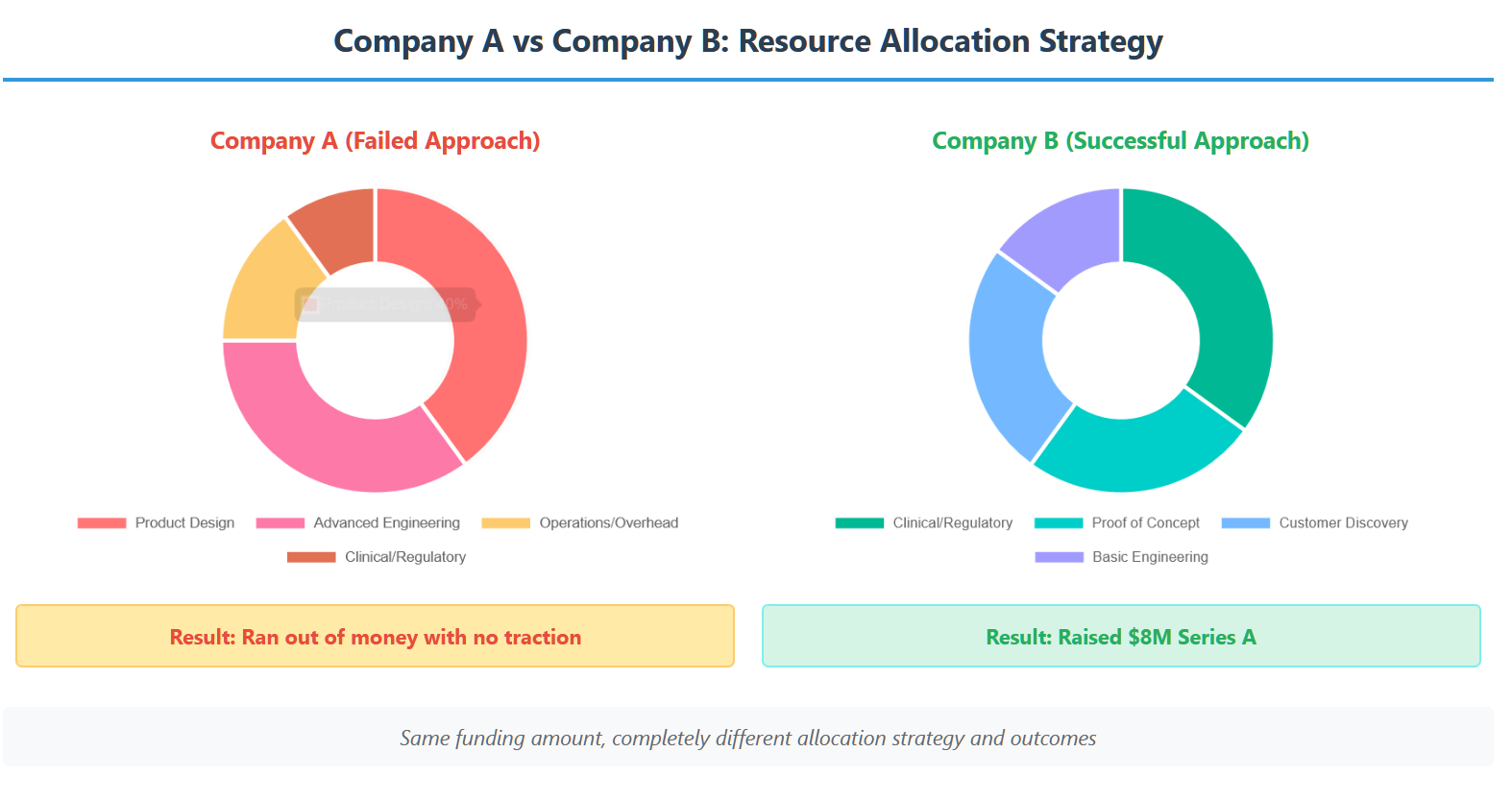

Case Study: Two Startups, Two Outcomes

Let me tell you about two companies I worked with, both developing cardiac monitoring devices.

Company A raised $2M and immediately started building a “perfect” device. They spent 18 months on elegant mechanical design, custom circuit boards, and sophisticated algorithms. When they ran out of money, they had beautiful prototypes but no clinical data, no regulatory progress, and no customer validation. They folded.

Company B raised the same $2M but focused ruthlessly on proving clinical utility. They built a crude but functional prototype using off-the-shelf components, partnered with a local cardiologist for a small pilot study, and used the data to secure FDA pre-submission meetings. When their initial funding ran out, they had clear regulatory guidance and preliminary clinical evidence. They raised $8M in their next round.

The difference? Company B understood that their primary goal wasn’t to build a perfect device—it was to build enough evidence to justify the next round of funding.

Calculating Your Runway to Revenue

Most entrepreneurs have no idea how much money they’ll actually need to reach sustainable revenue. Here’s a framework for calculating your true runway requirements:

Monthly Burn Rate Calculation:

Team salaries (including benefits): $50K-$150K/month Development contractors: $20K-$80K/month

Regulatory consultants: $10K-$30K/month Office, legal, accounting: $10K-$25K/month Total monthly burn: $90K-$285K

Major Milestone Costs:

Clinical studies: $500K-$2M

FDA submission and review: $100K-$500K Manufacturing tooling: $200K-$1M Initial inventory: $100K-$500K

Sales and marketing ramp: $200K-$1M

The brutal truth: You probably need 2-3x more money than you think, and it will take 2x longer than you expect. Plan accordingly.

The Survival Strategies

If you’re serious about avoiding the valley of death, here are the strategies that actually work:

1. Raise More Than You Think You Need

The biggest mistake I see is entrepreneurs raising just enough money to hit their next milestone. Markets change, development takes longer than expected, and FDA reviews get delayed. Raise enough to hit your milestone AND survive 6-12 months of unexpected delays.

2. Focus on Customer Evidence Early

Technical risk is scary, but commercial risk kills companies. Start talking to potential customers from day one. Get letters of intent, conduct user studies, and build relationships with key opinion leaders. This evidence becomes crucial for investor conversations.

3. Build Regulatory Relationships

FDA pre-submission meetings are your friend. Use them early and often. Regulatory consultants are expensive but worth every penny if they can prevent costly delays or wrong turns.

4. Plan Your Funding Sequence

Don’t think in terms of “the big fundraise.” Think in terms of a sequence of funding rounds, each designed to reach the next major inflection point. Seed round for proof of concept, Series A for clinical validation, Series B for commercialization.

The Path Forward

The fuel problem is real, but it’s not insurmountable. The companies that succeed are those that understand the true economics of medical device development and plan accordingly.

In our next article, we’ll dive deep into the MVP strategy—how to ruthlessly cut features to save your company while still building something that matters to patients and clinicians.

Remember: your goal isn’t to build the perfect device. It’s to build enough evidence to justify the next round of funding. Stay focused on the inflection points, manage your burn rate religiously, and always assume everything will take longer and cost more than you expect.

The medical device industry needs innovative solutions, but it needs sustainable companies even more. Make sure you have enough fuel to reach orbit.